The open road is a symbol of freedom, painting a romantic picture of breezy drives with the landscape blurring past. However, this idyllic image can be shattered in an instant when an accident occurs, particularly if the vehicle involved is not covered by auto insurance.

This blog post delves into the often overlooked scenarios of uninsured car accidents, the devastating financial burden of repairing a totaled car out-of-pocket, and the implications of navigating the aftermath without an insurance safety net. We’ll also provide guidance on how one can mitigate losses by selling an uninsured wrecked car to a junk car buyer, turning a distressing situation into an opportunity to regain some reliable cash. Stay with us as we navigate the winding roads of risk, offering insights on how best to deal with these complex situations.

The Consequences of Causing an Uninsured Car Accident

It’s no secret that car accidents can be detrimental to one’s financial stability. However, the stakes are raised to a whole new level when the vehicle involved is not covered by auto insurance. In this scenario, the driver responsible for causing the accident must fully cover all costs associated with repairing or replacing their car, as well as any damages or injuries caused to others. This can easily amount to tens of thousands of dollars, quickly draining one’s savings and potentially leading to severe financial strain. Furthermore, the driver may face legal consequences for driving without insurance, compounding their already dire situation.

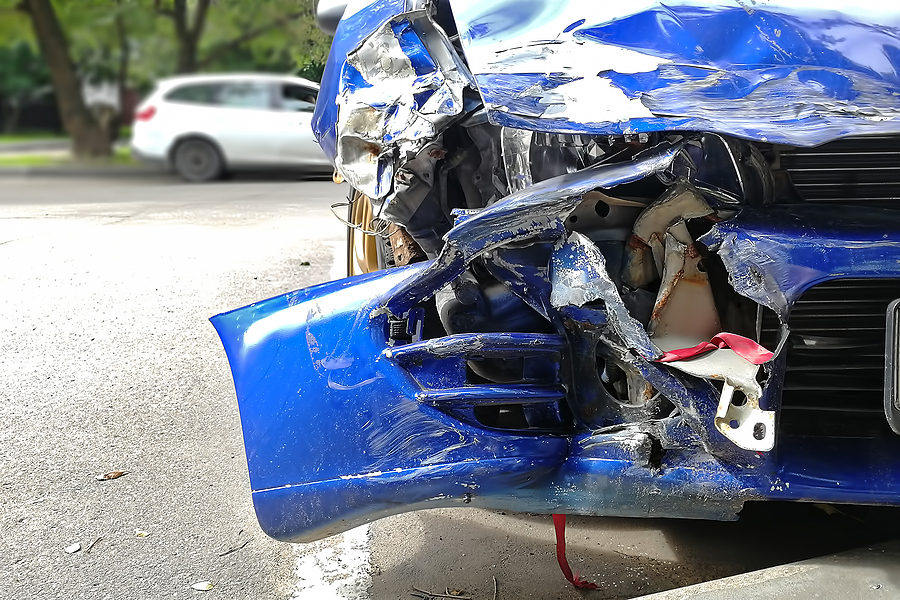

The Cost of Repairing an Uninsured Wrecked Car

The extent of the financial burden caused by an uninsured car accident depends on various factors, such as the severity of the damage, type of vehicle, and availability of parts. In some cases, repairing a totaled car may not even be an option, leaving the driver with no choice but to replace their vehicle entirely. This can result in significant losses, particularly if the car was relatively new or had a high market value. Additionally, the lack of insurance coverage means that the driver cannot rely on their policy to provide rental car expenses or cover lost wages due to potential injuries sustained in the accident.

Selling an Uninsured Wrecked Car to a Junk Car Buyer

As daunting as it may seem, there is still hope for those who find themselves with an uninsured totaled car. One option is to sell a wrecked car to a junk car buyer, who will purchase the car for its scrap metal value. While this may not yield as much money as selling a functional car would, it can still provide some relief from the financial burden of repairing or replacing the uninsured wrecked car. To sell to a junk car buyer, one must first determine the actual cash value (ACV) of the car, taking into account its age, condition, and scrap metal prices. Then, it’s a matter of finding a reputable junk car buyer who will provide a fair price for the vehicle.

In Conclusion

Driving without auto insurance is not only illegal but also puts one at great financial risk in case of an accident. The consequences of causing an uninsured car accident can be overwhelming, with the cost of repairing or replacing a totaled car being just one aspect. However, by understanding the options available and taking steps to mitigate losses, such as selling to a junk car buyer, drivers can navigate these situations more confidently. Remember to always prioritize safety on the road and ensure that your vehicle is adequately insured before embarking on any journey.

Ready to receive fast cash for your uninsured wrecked car? Sell it now! Contact us at 317-450-3721 to speak with an Indianapolis cash for junk cars buyer and get a free offer today. We serve all of Central Indiana and offer free junk car removal services.

Related Posts:

Uninsured Car Accidents: What You Need to Know

Understanding High-Cost Car Repairs: What You Need to Know

Should I Try to Sell My Old, Wrecked Vehicle?